We appreciate your interest in our services! If possible, please provide us with your contact details and a brief description of the services you are interested in, particularly translation services in Dubai. We will respond to you promptly. Thank you!

ASLT is accredited by the Ministry of Justice, Dubai, UAE. Our professionals are very competent in providing translation services to valued customers in the fields of Legal, Medical and Technical documents in more than 200 languages with high accuracy, fluency and reliability so that our customers can use their documents worldwide for desired purposes. Our satisfied customers’ reviews say it all!

Furthermore, all the individuals and companies can avail our customized proficient services related to translation, interpretation, transcription, Audiovisuals, mobile office legal translation, Subtitling services & Captioning, simultaneous interpretation equipment rental and Content Writing according to their requirements. Our services are the most outstanding and reliable with a supportive customer service. If you are in Dubai and looking for the best option, ASLT is the ultimate solution for you with guaranteed quality

At ASLT Legal Translation Dubai, we have a team of certified professionals that are native speakers of their proficient languages so their translated documents are universally accepted. Furthermore, in the world of Artificial Intelligence quality of text has been compromised. We are providing high quality human translated documents so that the desired audience can easily be communicated.

Our officially registered services are trusted Translation in Dubai as the company is accredited by the Ministry of Justice, the Ministry of Foreign Affairs, UAE. Our translated documents contain the ASLT seal of approval. That’s why our translated documents are accepted in all Public and Private organizations working in Dubai.

ISO 9001:2015

Certification No. 108179

Ministry of Justice UAE

Ministry of Foreign Affairs UAE

Dubai Courts

Dubai Police

Dubai Land Department

We have been providing service since 2007 in Dubai. We have a rich history of excellence. Customers’ satisfaction is our top priority. We provide customized reliable and time effective services keeping in view the requirements of our valued customers at a best affordable price in Dubai.

We have a team of industry professionals which are proficient in the language essence and have research experience in the fields of business, legal, medical, technical, education, finance and biotechnology due to which their produced work is highly up-to-date and accurate.

In spite of the best quality, ASLT facilities are very affordable; even we have the lowest rates per page as compared with other service providers in Dubai, UAE.

Every company desires to expand its business beyond its country’s territory. Effective communication is the key to success in this case. We enable the companies to communicate with the potential customers throughout the globe in the languages they understand. We have many success stories in our splendid history. Experience yourself and feel the quality excellence necessary for boosting your business.

We provide translation related to various professional fields like medical, technical, Legal, business, education and finance in Dubai.

We are the providers of best quality service with respect to accuracy and trustworthiness and also certified by the government authorities of Dubai

We provide the best interpreting facilities. The success of effective communication also lies in the accurate interpretation of a message. Our professionals are trusted interpreters in Dubai

We offer interpretation of more than 200 languages of communication around the globe. We ensure our clients that our interpreters will take best care of their interpreting languages

We have professional Audio Visual experts in our team at ASLT, Dubai dedicated to serving a large number of clients in achieving their audio visual needs with higher accuracy and quality.

Best content writing is a key in achievement of success in every field including marketing, business and Education. We have the best content writers in our team having much experience and research based content writing. Get your 100% human content writing after availing our services

Our experts are proficient in designing of books, booklets and brochures for our clients by refining their ideas and making them more appealing and eye catching

ASLT feels pride in having a network of more than 10000 professional linguists around the world like immigration translators, medical interpreters, app Website Localization Services and many more from across the globe. This makes our service recognized throughout the world. You can hire the expertise of any professional for your services.

Most Popular Language Pairs • Certified Translation Services • Every Type of Document Translation Services in Dubai

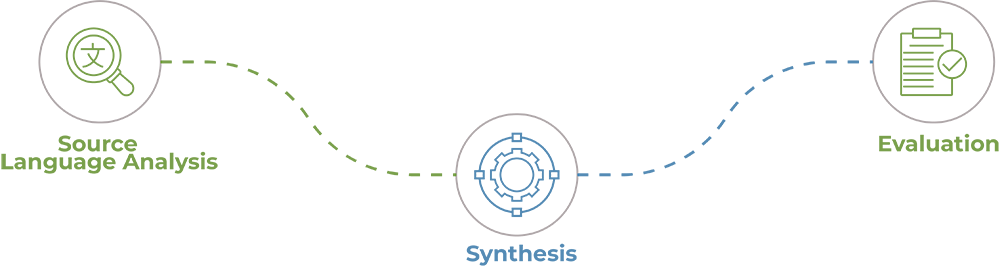

ASLT has three stages translation process comprising of the following:

We offer unlimited revisions till achieving the clients’ desired standard.

100% Guaranteed

100% Guaranteed

Frequently Asked Questions

Do you have any questions about the translation services or any other services provided by Al Syed Legal Translation, or any other inquiries? See below for the answers

ASLT has been the best legal translation services provider in Dubai since 2007.

They are Legal translations, medical translations, interpretation services, copywriting services, immigration translation, , technical translations Content Writing Services, audio visual services, Desktop publishing (DTP) services, transcription and captioning services.

ASLT provides best content writing service in Dubai

ASLT services is one of the leading translation services providers in Dubai, UAE registered from government authorities of Dubai. There are more than 10000 professional linguists around the world in our network and a vast range of services available in more than 200 languages pairs. We provide best quality, accurate, human written contents with guarantee of confidentiality at a very affordable price as compared with other translators at Dubai.

ASLT is accredited by the Ministry of Justice, the Ministry of Foreign Affairs, UAE.

ASLT provides services for 24 hours a day, 7 days of the week and 365 days of the year.

You can find tranlsation offices everywhere in UAE but if you search legal translation near me you will find the multiple locations. ASLT has multiple offices located in Jumeirah Lakes Towers - JLT (Al Mas Tower DMCC), and Emirates Office Tower - Main Shaikh Zayed Road.

ASLT offers certified legal translation services in Dubai for a wide variety of documents, including court judgments, legal notices, summons, affidavits, power of attorneys, criminal clearance records, various certificates, memorandum of understandings, agreements, reports, letters, invoices, emails, and social media messages.

Estimated cost per page is in between 50 AED to 100 AED depending upon the complexity, volume and urgency.

The Ministry of Justice and Ministry of Foreign Affairs UAE has given accreditation to ASLT for the languages; English, Arabic, German, French, Spanish, Italian, Russian, Chinese, Persian/Farsi and Turkish for legal translation. Therefore, ASLT is providing certified translation services in more than 200 languages pairs.

ASLT is offering online customer services and is known as a quick responsive service provider.

ASLT provides fast and error free Legal Translation service in Dubai as per needs of the clients.

ASLT is providing best quality and accurate audio Video transcription services, voice dubbing services, subtitling and simultaneous interpretation services in Dubai.

Your linguistic solution is just a call away. Contact Us:

Toll Free: 0800 7378 4237

Ph: +971503060266

Email: [email protected]

Making Your Business Easier to Understand: Professional Translation Services for All Industries